The Best Time to Invest in Africa is NOW!

‘‘The best time to invest in Africa is now‘‘ according to a recent report by the United Nations.

Globally, we are seeing a number of challenges buffeting the global economy and all of these has an effect on traditional and alternative asset classes in the developed and many of the emerging economies including China, India, Southeast Asia, South America etc.

The only region in the world that can produce strong returns in the short, medium and long term is Africa.

Therefore, in this article, we shall explore several challenges in the global markets and how investing in Africa is part of the solution.

However, I will also caution, that with high returns, one should also expect high risk, but this can be mitigated by the:

- Knowledge of the investor;

- The investment strategy;

- A strong portfolio management structure which should include a comprehensive, responsive and dynamic asset allocation framework that looks at one’s portfolio in totality.

1. The first challenge we are seeing is high inflation.

This is caused by growth in money supply without corresponding growth in products, services and consumption. We are seeing the velocity of money (the rate at which money is exchanged in an economy) at historic lows.

This growth in money supply really started after we entered the millennium and began to multiply exponentially after the 2007-2008 financial crisis as we entered a period of the ‘new normal’ with low interest rates and large quantitative easing which drove up the price of financial assets, allowing listed companies to do buybacks to increase their stock prices.

However, this expanded money supply has not really trickled into the real economy where small businesses still have challenges accessing capital.

Furthermore, strategic projects with long paybacks were starved of investments and we are left with the incredible position today, where we have had more than two decades of very loose monetary policies but in most developed nations, infrastructure is crumbling, critical investments in the energy and food supply chain have not been undertaken.

As a result, we are facing higher food prices, higher energy costs, higher taxation, higher prices for services and lower rates of real investment returns after they have been adjusted for inflation and the real certainty that these conditions will persist for at least the next decade.

Investing in Africa offers returns that significantly beat the rate of inflation, therefore by investing in Africa, investors are able to achieve higher real rates of investment returns as well as diversifying their portfolio and reduce systematic risks.

2. The second challenge is low interest rates and an overall lowering of investment returns.

The nature of money itself is that it can only be created through debt. When we speak about quantitative easing or the expansion of the money supply, we are essentially speaking about an increase in indebtedness of nations, corporates and eventually families.

With the increasing debt levels, even a small increase in interest rates can have devastating consequences for the global economy.

On the other hand, interest rates is the price of money and in a free and healthy economy, the price of money like everything else should go higher or lower with demand.

When money is not subject to that same market dynamic, it begins to create a distorted economy, because almost everything is priced in monetary terms, including risk.

This mispricing hurts the most vulnerable in society; the pensioners who rely on returns from the financial markets, especially the bond markets to survive.

Investing in Africa alleviates this somewhat because of the consistent high returns that can be achieved.

3. The third challenge is deteriorating social dynamics resulting in shrinking economies.

Many of developed nations in the world have shrinking economies right now and for seeable future.

This is especially difficult to manage when coupled with high public, corporate and personal debt levels. The way it is being managed in these economies, is to increase taxes and artificially create demand through social programmes with the State, playing an increasingly large role as a market actor.

This is not sustainable or even desirable, because it requires the State to continue borrowing and raising taxes, which restricts the growth of the economy and crowds out private investment.

With ballooning debt, slowing economies, high tax burdens and a rapidly ageing population; the developed and indeed many developing economies including China, are not suitable long term investment options.

In conclusion, the most devastating effect of all the above challenges is - it kills enterprise and innovation.

There is an expression that says ‘necessity is the mother of innovation’, if there is no necessity, if there is no incentive, where will the innovation come from? How can we have a vibrant society where there are no rewards for taking risks, working harder and working smarter.

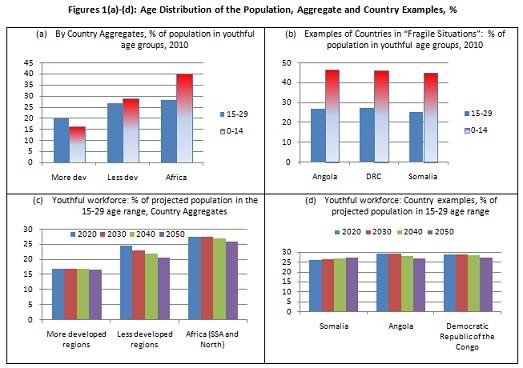

Africa on the other hand boasts most of the most vibrant and growing economies in the world even after C0VID 19, it also possesses a very young population which bodes well for technological adoption and innovation (indeed, Africa is leapfrogging the world in areas of financial technological adoption and usage) and it is integrating and speaking with one voice as a continent for the first time.

It has demonstrated this intent to integrate through the mass adoption of the AfCFTA (African Continental Free Trade Agreement) and as a result, we are seeing an increase in intra Africa trade between African economies across the continent.

This internal market growth is driving companies across Africa to begin investing in processing capacity and continent-wide marketing strategies which in turn creates economic opportunities and jobs across the value chain and which further drives local community development.

The recent opening of the Dangote Fertilizer Factory is a clear statement of intent about the future of things to come for Africa because now for the first time ever, fertilizer from Africa is being exported to the rest of the world.

When all these considerations are taken into account, it becomes clear that Africa is the future and now is the time to enter.

It is not my intention to paint a rosy picture of investing in Africa, it is fraught with risks of all kinds, however risk primarily materializes from a lack of knowledge and not knowing what one is doing, not having the right partners and not having access to the best opportunities.

Based on the factors mentioned above, we have prepared an academy where we teach people where and how to invest in Africa, not only that, we are building a thriving online community of likeminded investors and finally, we are also building an investment platform where our students will have access to superb, curated investment opportunities to put what they have learnt in the Academy into practice.

The starting point for all of these is the introductory course we have prepared below. It is offered at the introductory price of 199 pounds sterling. This course is a prerequisite for those who desire to be part of our programs because it helps create the right foundation for the rest of the programs.

Please do NOT sign up if you meet the following conditions:

- Are not interested in learning;

- Are not serious about creating generational wealth;

- Are a casual observer;

- Are not going to act on what you have learnt;

- Are only interested in conventional investments.